Eleven Straight Months

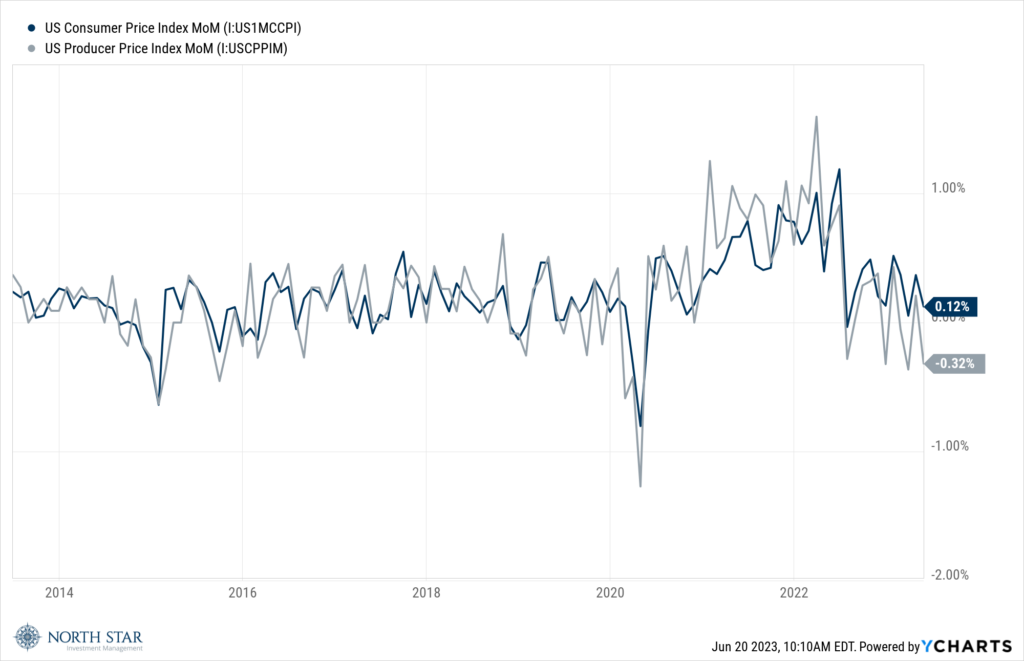

The new bull market got a nice boost from the inflation data with CPI only +0.1% for the month and PPI decelerating even more dramatically to measure only +1.1% for the 12 months ended in May. Producer prices have now been cooling for eleven straight months, and those input prices tend to have a significant impact on consumer prices with a short lag. We first noted the lag dynamic between PPI and CPI in March 2021, when PPI components began accelerating but CPI was within a comfortable Fed target range, but alas ‘transitory’ became systemic and Fed commentary turned hawkish by the end of 2021. The same dynamic seems to be playing out in reverse approximately two years later. As expected, the Fed paused its rate hikes at the June meeting on Wednesday, although Chairman Powell nevertheless suggested that 2 future hikes were likely (as indicated by the Fed’s dot plot graph), remarking that he didn’t see any downward trend in inflationary pressures over the last 6 months. Although price increase trends remain above Fed targets designed to meet its “price stability” mandate, the graph below contradicts Powell’s recent comments. The graph below shows CPI and PPI over the last 6 months; the inflation trend clearly has normalized over the last 6-plus months as imbalances resulting from the pandemic combined with the fiscal and monetary response move into the history books.

We believe the Fed’s underlying strategy is two-fold. First, to continue to jawbone-down investor and consumer sentiment to prevent another ramp up in inflation and to limit the oft-cited wealth effect of increased consumer spending from potentially overheated financial markets. Second, to consider that raising rates further currently could create additional liquidity problems for the banks and other financial institutions, which could severely hurt the economy. Despite our criticisms, we recognize that the Fed has a very difficult job trying to restore prudent monetary policy after 15 years of disruption, first from the financial crisis and more recently because of the pandemic.

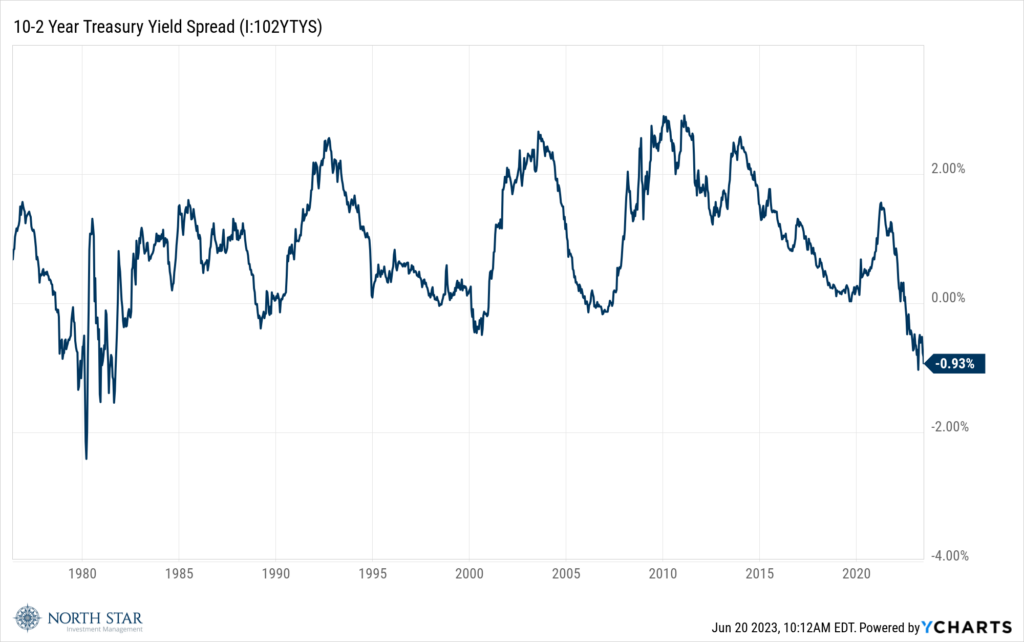

The markets responded positively to the inflation data and Fed pause, with the S&P gaining 2.6%, the Nasdaq adding another 3.3%, while small caps had a quiet week inching up 0.5%. Once again it was the Tech sector leading the charge, with only the Oil & Gas sector declining, despite a 2% bounce in crude prices. The yield on the 10-Year Treasury was basically unchanged, but the 2-Year rate kept rising leading to the inversion of the 10-2 spread reaching its highest level since the early 1980s.

What does it all mean? On balance, the bond market seems to be signaling that the global economies are in a period of slowing growth that may lead to lower interest rates and inflation, while the stock market is painting a more optimistic picture for future corporate profits of U.S. companies as the domestic economy continues to show tremendous resilience.

History and Testimony

The U.S. Markets were closed on Monday in observance of Juneteenth, which is an annual commemoration of the end of slavery in the United States after the Civil War. According to the Smithsonian’s National Museum of African American History & Culture website, “Even though the [freeing of slaves in Confederate state by the] Emancipation Proclamation was made effective in 1863, it could not be implemented in places still under Confederate control. As a result, in the westernmost Confederate state of Texas, enslaved people would not be free until much later. Freedom finally came on June 19, 1865, when some 2,000 Union troops arrived in Galveston Bay, Texas. The army announced that the more than 250,000 enslaved black people in the state, were free by executive decree. This day came to be known as Juneteenth by the newly freed people in Texas.”

The calendar the rest of the week is quiet, with Thursday being busy with housing data, the Leading Economic Index for May, and Fed Chairman Jerome Powell testifying before the Senate Banking Committee.